Foreword

There are two order types when talking about buying or selling securities – Market order and Limit order. In this article, I am going to illustrate what Limit Order is and discuss the Pros and Cons while using it. Also, I will use examples to ensure you know what I am talking about.

What is Limit Order?

A limit order is an order that you sent to your broker to buy or sell a security at a specified price or better. Your order would only be filled when someone buys or sells securities at the price specified in your order or even better.

You may not know what does better means in this part. You might find the answer in the following examples.

(You could also check out the article written by professionals of Investopedia)

Examples

BUY Limit Order

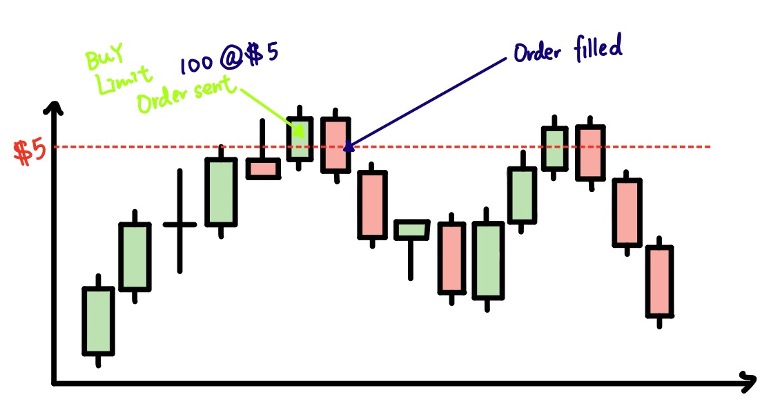

Buying shares below the current ask

Assume you send a limit order with at most $5 per share to buy 100 shares, and the current ask is higher than $5. Your order will then sit on the bid to wait for sellers. If the price dips and is lower or equal to $5, your order would be filled. The amount of money you need to pay is 100 x $5 or less = $500 or less. The ECN fee would not be charged in this case since you do not remove any liquidity from the market.

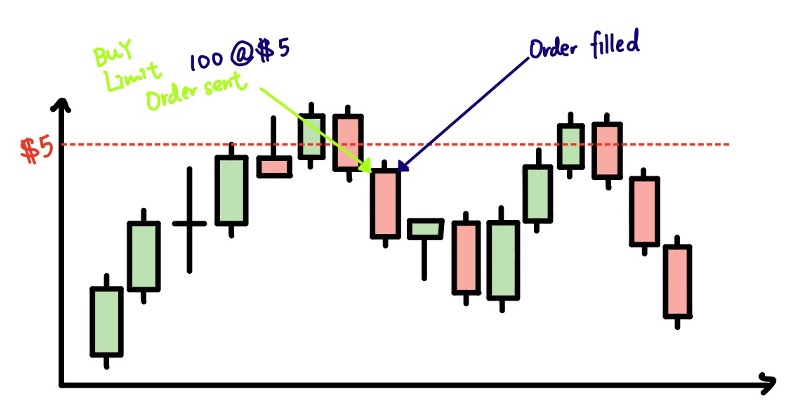

Buying shares at or above the ask

Assume you send a limit order with at most $5 per share to buy 100 shares, and the current ask is lower than $5. Your order would be filled immediately. The amount of money you need to pay is 100 x current ask +ECN fees = less than $500. The ECN fee would be charged in this case since you remove liquidity from the market.

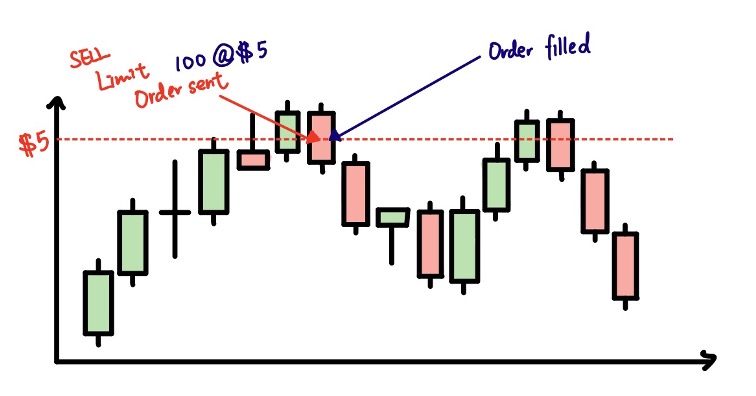

SELL Limit Order

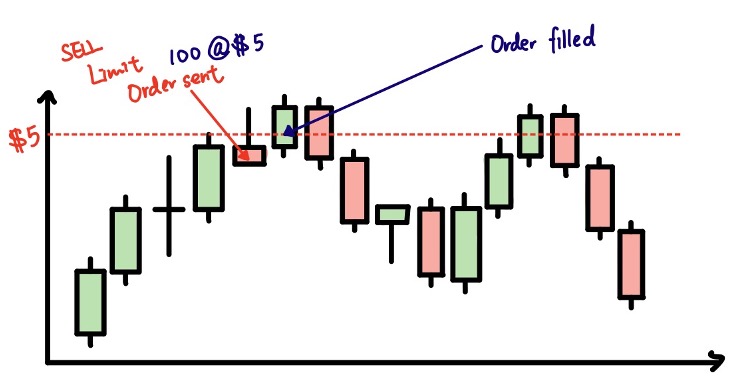

Selling shares above the current bid

Assume you send a limit order with at least $5 per share to sell 100 shares, and the current bid is lower than $5. Your order will then sit on the ask to wait for buyers. If the price spikes and is equal to $5 or higher, your order would be filled. The amount of money you received is 100 x $5 or more = More than $500. The ECN fee would be not charged in this case since you did not remove liquidity from the market.

Selling shares at or below the bid

Assume you send a limit order with at least $5 per share to sell 100 shares, and the current bid is higher than $5. Your order would be filled immediately. The amount of money you received is 100 x more than $5- ECN fees = More than $500. The ECN fee would be charged in this case since you remove liquidity from the market.

What if there is not enough buyer or seller for your order?

You may find that sometimes the limit order is partially filled. It is because there is not enough buyer or seller in the market to buy or sell you shares at the price specified in your order.

What will happen?

As previously mentioned, a Limit order would only be filled when someone buys or sells the security at the price specified in your order or even better. Thereby, your order would be partially filled with shares at the price specified in your order. The rest of your order would sit either or the bid or ask until you cancel them.

Examples

BUY

Let’s say you send a limit order to buy 17000 shares with $6.45. The current ask is $6.45 and the size is (160+1+1+1+1+1) x 100 = 16500 shares. Your order is first partially filled with 165000 shares in $6.45. Then, the rest of the 500 shares would sit on the bid at $6.45.

SELL

Let’s say you send a limit order to sell 6000 shares. The current bid is $6.44 and the size is (34+20+2) x 100 = 5600 shares. Your order is first partially filled with 5600 shares at $6.44. Then, the rest of the 400 shares would sit on the ask at $6.44.

More Examples and Different Scenarios: What happens on Level 1&Level 2 when you send a Limit order?

Pros and Cons

Pros

1. Prevent slippage

2. Good for buying dips

Cons

1. May not or partially filled when the price is spiking or tumbling.

2. Hard to utilize when using phone to trade

Final Thought

Acquiring how to use the Limit Order would definitely help you to become a better trader.

[Next Lesson: Stop order]