This page contains affiliate links. This means that we may earn a commission if/when you click on or make purchases via affiliate links.

Foreword

Do you know what is Fundamental Analysis? Fundamental Analysis is one of the major approaches that investors and traders rely on when determining the timing to jump into the financial market. Understanding how it works is essential to build your foundation in stock trading. In this article, I will walk you through some basics of fundamental analysis is.

What is Fundamental Analysis?

Fundamental Analysis is an analysis methodology that allows investors and traders to invest in a company based on what is happening. Different from Technical Analysis, Fundamental Analysis is much more reliable when predicting the movement of security price. The reason is that it is easier to forecast how the public will react to news released by companies compared to how traders will act on support & resistance lines.

Fundamental Analysis can be used in both long-term investment and short-term trading. However, short-term traders seldom use fundamental analysis (except catalyst) when planning time to jump into the financial market as it has nothing to do with the intraday price movement (also known as price action).

On the contrary, Fundamental Analysis is indispensable when it comes to long-term investing. Long-term investors rely heavily on Fundamental Analysis. It allows them to make precise decisions by going through companies’ financial reports. And help them to profit from the company growth.

How do they use Fundamental Analysis?

Investors and traders both use Fundamental Analysis though they use it for different purposes and ways.

Investors

Often, investors use both technical analysis and fundamental analysis before they even purchase stocks. They will first evaluate the growth potential of a company by going through its financial papers. For instance, income statements, balance sheets, cash flow statements, and more.

| Financial Papers | What is included? |

|---|---|

| Income Statement | How did the company perform throughout a period? |

| Balance Sheet | What does the company own and owe at a certain date? |

| Cash Flow Statement | How much cash did the company make/come from? |

By going through these statements, extracting some numbers for financial analysis, and making predictions on the sector outlook, investors could judge whether it is worth investing in the company.

After they have made their decision to invest in the company. They will then use the technical analysis to find the best timing to buy shares of a company, maybe buy in dips, trend reversals, or else.

Traders

Often, traders only use technical analysis when purchasing stocks. However, before purchasing, they will still rely on fundamental analysis. They will read the news released by the company, then judge whether they would drive the stock price and further make profits from it.

Afterward, they will start doing technical analysis of the stock on charts by drawing support and resistance lines. If the stock price spike/fall due to the news released on that day, they will trade the stocks.

Little Tips: sometimes, news released on previous days or even weeks could also affect today’s stock price. The less known the stock is, the more likely it happens.

How to do fundamental analysis?

In common, investors will read news, index, and go through financial papers to do fundamental analysis on security.

News

Various news released by the companies could affect its stock price differently. Some may boost the stock price, and some may lead to a drop in stock price. In the following, I will walk you through the common types of news (also known as catalysts) and how they affect the stock price. So that you can forecast the price movement of stock when some news is released.

| News Types🗞️ | Positive👍🏻/Negative👎🏻catalyst? | Stock price📊? |

|---|---|---|

| Earnings💰 | 👍🏻/👎🏻 | Stock price may rise when the company's earning beats the previous one, vice versa. Sometimes, even if a company doesn’t lose as expected, it may drive the price to go up. |

| FDA/Clinical Trial Announcement 💉 | 👍🏻👍🏻👍🏻 | Stock price often rise when the company’s project has been approved by FDA or pass the Clinical trial. |

| Mergers or Buyout💸 | 👍🏻/👎🏻 | Stock prices may fluctuate when a company has merged with or bought up by another company. |

| Stock Split🪓 | 👎🏻 | Stock price may fall due to the increase in stocks supply. |

| Reverse Stock Split🧲 | 👍🏻 | Stock price may spike due to the decrease in stock supply. |

| Analyst Target🏹 | 👍🏻/👎🏻 | Stock price may rise/fall when some analysts say the stock target is higher/lower than the current one. |

| Activist Investor Position✔️ | 👍🏻/👎🏻 | Stock price may rise when some famous people are investing in the stock with a huge position. |

| New order/contract/Partnership📜 | 👍🏻 | Stock price may rise when a company announces that they have new projects, orders, contracts, or become a partner with big companies. |

| Secondary Public Offering🗓️ | 👍🏻/👎🏻 | Stock price may fall after a Secondary public offering. However, in some cases, when the price of the secondary offered stocks is higher than the current ones, the stock price may rise. |

Financial reports

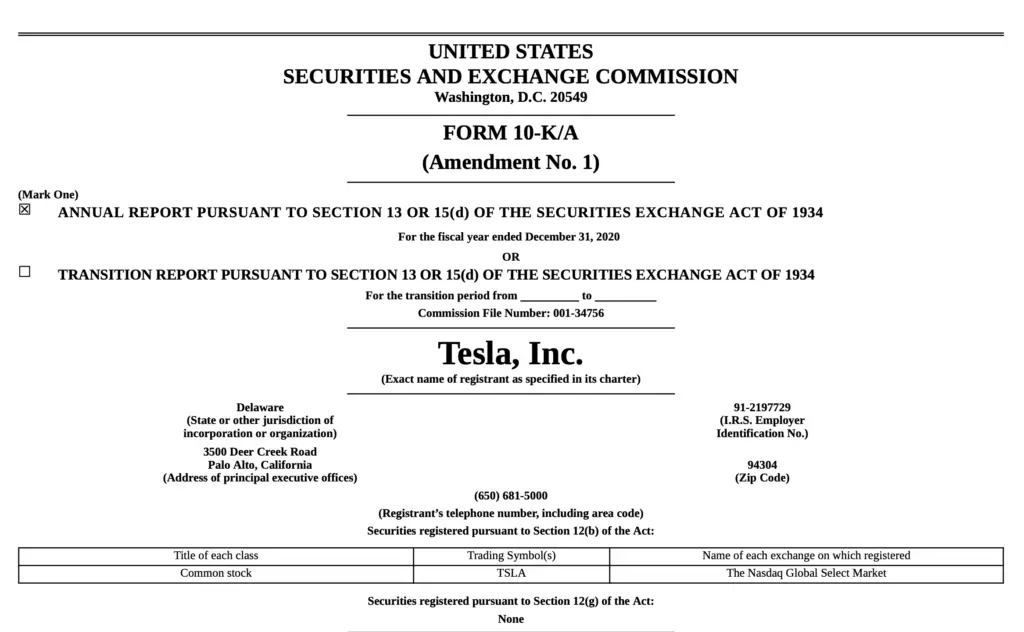

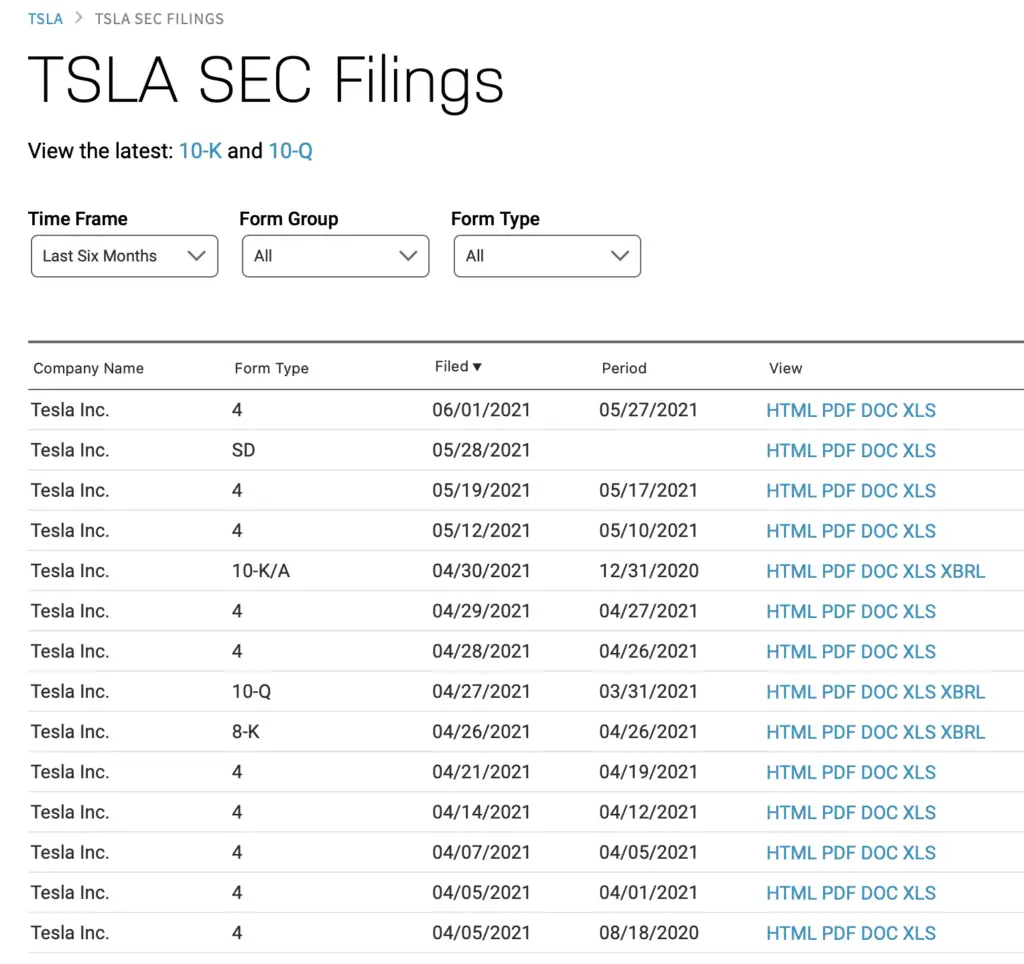

There are multiples papers when talking about financial reports, and each of them is named differently. For instance, 10-K report, 8-K report, and more. In the following, I will walk you through the most common ones. So that you will understand what they mean and know what you could find in these filings.

| Financial Reports 📜 | Who's reading? 🥸 | What is it?💁🏻♂️ | What is included?🤌🏻 | When it publishes?📆 | Where to find?🔍 |

|---|---|---|---|---|---|

| Annual Report | Shareholders + General Public | Reference Yearbook | 1. Letter from CEO and chair of the board of directors 2. Review of company history. 3. Major company divisions and subsidiaries, operations, and various initiatives over the preceding fiscal year. 4. Balance sheet 5. Income statement 6. Cash flow statement 7. Last year financial Performance comparison to past years | Yearly | Company's website |

| 10-K Filing | SEC | Form submitted to SEC | 1. Overview of the company’s main operations 2. All risks the company faces 3. Specific financial information about the company over the last five years 4. Senior management's explanation of its financial results 5. Income statement 6. Balance sheets 7. Cash flow statement | Yearly | Nasdaq.com |

| 10-Q Filing | SEC | Form submitted to SEC | 1. Income statement 2. Balance sheets 3. Cash flow statement 4. Management discussion and analysis 5. Disclosures 6. Internal controls for the previous quarter | Quarterly (First 3 Quarter) | Nasdaq.com |

| 8-K Filing | Shareholders + SEC* | Announce of unscheduled material events or corporate changes that could be of importance to the shareholders or the SEC | 1. Acquisitions 2. Bankruptcy 3. The resignation of directors 4. Changes in the fiscal year | As-it-happens | Nasdaq.com |

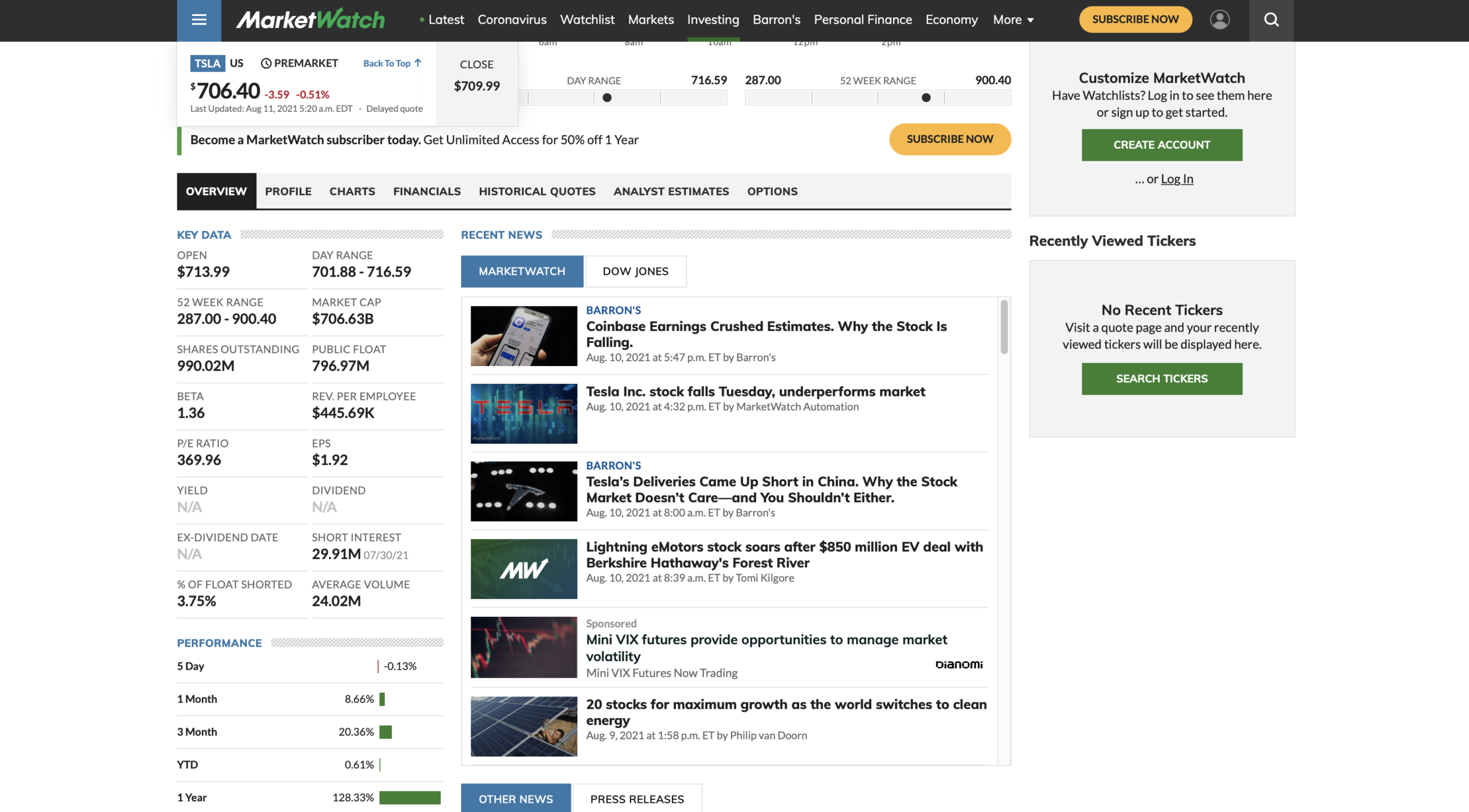

Index Analysis

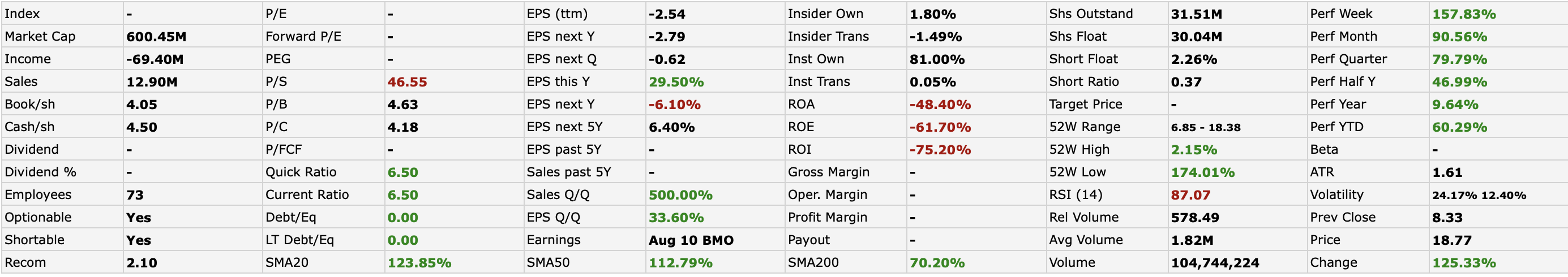

There is plenty of indexes used nowadays by different investors or traders. In the following, I will walk you through the most used ones and what they are calculating.

| Index🔢 | Calculation🧮 | Result❓ |

|---|---|---|

| Market Capitalization | No. of shares * Stock Price | Evaluating the size of a company |

| Book value | Asset-Liability | Calculating the equity |

| Book per share | Book value/ shares | Checking whether the stock is undervalued or not (if book/share > market price = undervalued) |

| Price per book | Market Capitalization/ book value | Calculating the price of a stock in book |

| Earnings per share (EPS) | Earning/shares | Calculating the earning per shares |

| Price to earning (P/E) | Stock price/ EPS | Calculating the return on investment (ROI) |

| Return on equity (ROE) | Profit/equity | Calculating the profit per equity/book |

| Dividend yield | Dividend/stock price | Calculating the yield of dividend |

You can find more on Finviz.com.

Final Thought

Understanding how to do a fundamental analysis of security is essential when it comes to trading or investing. In this article, I have briefly illustrated what Fundamental Analysis is and go through the basic item you need to know when doing fundamental analysis. Hope you find it helpful.