Foreword

Do you know what the ECN fee and Liquidity are? When calculating the total cost of our orders, knowing what ECN fees and Liquidity are would be essential since they may affect our profit. Additional fees would be added to your order if you are not familiar with them. In this article, I will walk you through both ECN fees and Liquidity. Different ECN fees would also be included for your reference.

What is ECN?

Before talking about ECN fees, we are to know what Electronic Communication Network (ECN) is. “Electronic communication network (ECN)” is a trading system that owned by different exchanges for the trading of securities. Every time we send our orders (instruction) to our brokers, they will then send our orders either to various ECNs or a specific ECN for finding match and getting our order filled.

Routing methods and their Pros and Cons

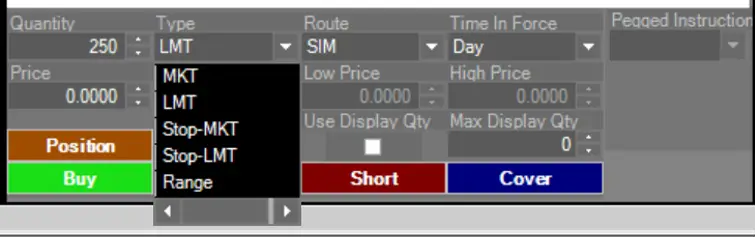

As previously mentioned, brokers would send our orders either to various ECNs or a specific ECN. They are called Smart order routing (SOR) and Direct order routing (DOR). Both of them have their upside and downside when using them. We can include which routing we are going to use in our order as well as the ECN.

| Direct Order Routing | Smart Order Routing | |

| Additional Routing Fee💸 | ✅ | ❌ |

| Search pending orders from other ECN🔍 | ❌ | ✅ |

| Filling speed 🚀(With pending order waiting) | 👍🏻 | 😐 |

What is Liquidity?

Apart from ECN, liquidity is another terminology we need to know before talking about the ECN fees. Often, I found articles writing about liquidity is a bit abstract and complicated.

To understand it, you could think of liquidity as a unit that tells you whether the market is hot or not depending on the number of pending orders in the market (Just like the degree we used in a thermometer). The more the pending orders, the high liquidity it is.

When we say an asset has high liquidity, it means that the asset could be traded quickly and easily, vice versa.

ECN fees

As ECN owners, they can earn more when there are more trades done on their network. They thereby hope to increase pending orders in the network as much as possible by awarding people who add liquidity to the network and charging people who remove liquidity from the network fee. The award and fee vary with different brokers.

Here is an example of ECN fees.

| ECNs | Adding Liquidity | Removing Liquidity |

|---|---|---|

| MNGD | $0.004/share | Free |

| INET (NSDQ) | Free | $0.003/share |

| EDGX | Free | $0.004/share |

| EDGA | Free | Free |

| NYSE | Free | $0.004/share |

You could find out more from different broker, for instance, Lightspeed, TradeZero and Interactive Broker. (Some may charge you commission per trade in stead of charge you ECN fees)

What is Removing Liquidity and Adding Liquidity?

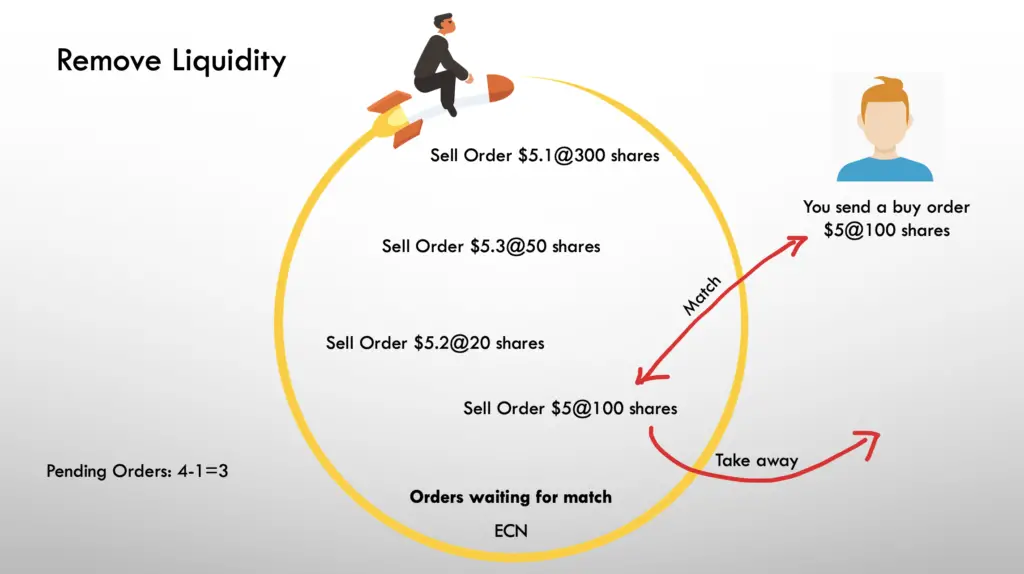

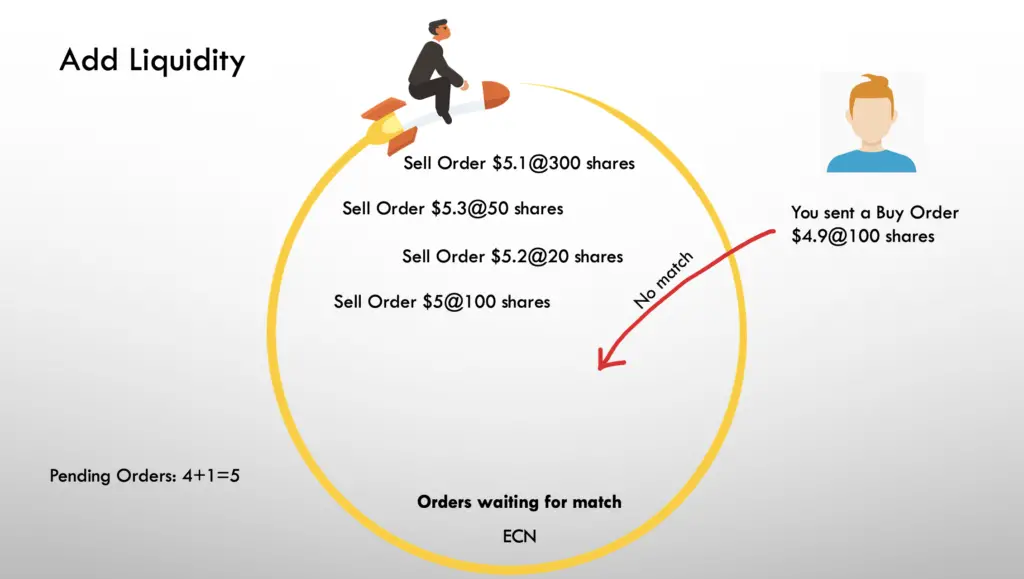

You may wonder what it looks like when you are removing liquidity or adding liquidity. Here are some images for you to have a better understanding of them.

You lower the liquidity when you sent an order to the market and make a match with one of the pending orders (Known as remove liquidity).

And you increase the liquidity when you sent an order to the market and did not make any match (Known as add liquidity).

Final Thought

Understanding ECN and its fees is essential for stock trading since they can affect your profit. Besides, Liquidity is another important terminology. It lowers your risk when you know how to utilize it.

[Next Lesson: Market Order]