Foreword

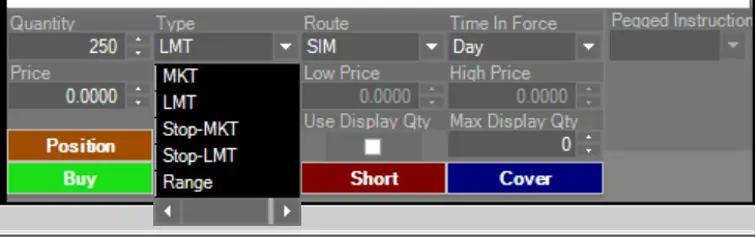

There are two order types when talking about buying or selling securities – Market order and Limit order. In this article, I am going to illustrate what Limit Order is and discuss the Pros and Cons while using it. Also, I will use examples to ensure you know what I am talking about.

What is Market Order?

A Market Order is an order that you sent to your broker to buy or sell a security with its market price. Most of the time, your order would be immediately filled when you send the order. It would be executed at the best available price in the market, the bid and ask (from Level 1).

Here are some examples of using the Market order when stock trading.

(You could also check out the articles written by professionals of Investopedia)

How Market Order works?

BUY Market Orders

BUY: Assume you want to buy 100 shares. With the current ask of $5.82 per share, you need to pay 100 x $5.82 + ECN fees = $582↑ to acquire them when using a market order.

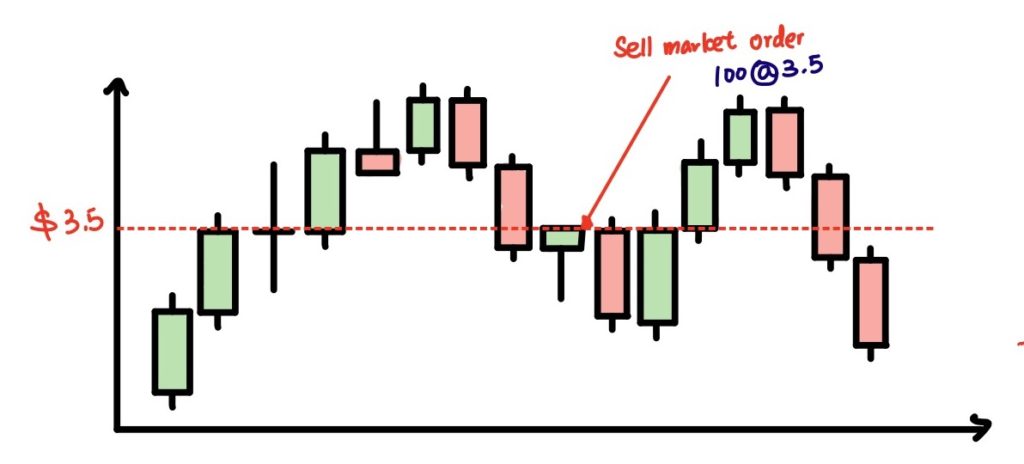

SELL Market Order

SELL: Assume you have 100 shares, and you would like to sell all of them. With the current bid of $5.81 per share, you would get 100 x $3.5+ ECN fees = $350↓ with a market order.

What if there is not enough buyer or seller for your order?

You may find that sometimes our market order is filled with shares in different prices. It is because there is not enough buyer or seller in the market to buy or sell you shares in the current bid or ask.

What will happen?

As previously mentioned, a market order would be executed at the best available price in the market. Thereby, after your order is partially filled with the current bid or ask, your order would then be filled with the next bid or ask.

(Next Bid: Often in lower price | Next Ask: often in higher price)

Examples

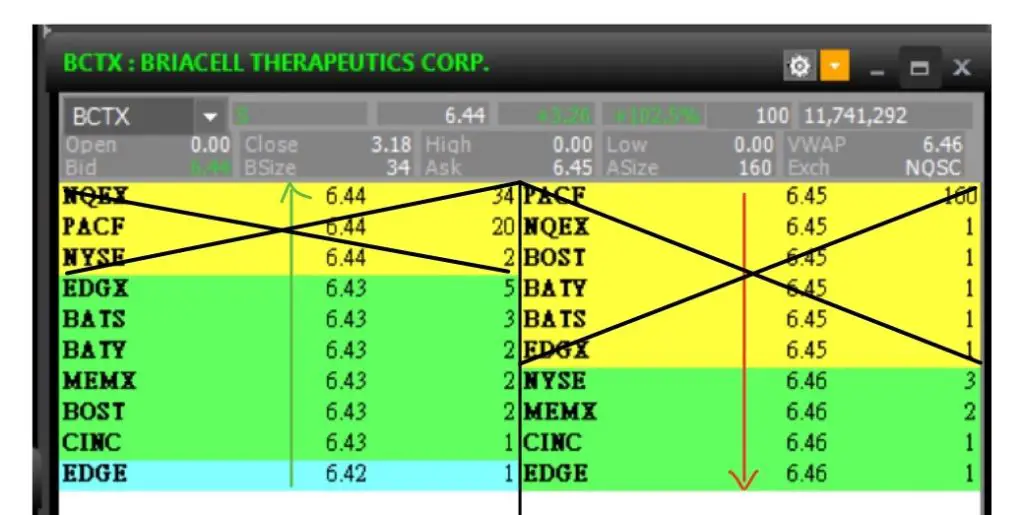

BUY

Let’s say you send a market order to buy 170000 shares. The current ask is $6.45 and the size is (160+1+1+1+1+1) x 100 = 165000 shares. Your order is first partially filled with 165000 shares in $6.45. Then, the rest of 5000 shares would be bought at the next ask price of $6.46.

SELL

Let’s say you send a market order to sell 6000 shares. The current bid is $6.44 and the size is (34+20+2) x 100 = 5600 shares. Your order is first partially filled with 5600 shares at $6.44. Then, the rest of the 400 shares would be bought at the next bid price of $6.43.

More Examples and Different Scenarios: What happens on Level 1&Level 2 when you send a Market order?

Pros and Cons when using Market Order

Pros

- Order would be filled immediately

Cons

- May have slippage due to partial fills of orders with shares in different price.

Final Thought

Acquiring how to use the Market Order would definitely help you to become a better trader.

[Next Lesson: Limit order]