Foreword

The ability to accept loss is essential when it comes to investing and trading. Many investors and traders have struggled with this process for a long time and suffered huge losses since they aren’t willing to admit that they are wrong. Stop order is thereby being frequently used to help traders and investors jump through that process.

In this article, I am going to walk you through what is a Stop Order and provide you some easy-to-understood examples so that you can have a better understanding of it.

What is Stop Orders?

A stop order is an order you sent to your broker to buy or sell your security when its price past your set trigger price. It could only be sent when you are holding a position (long or short) and will never be triggered as long as the security’s price does not reach the set trigger price. The Stop Orders are designed to minimize traders’ loss.

Stop Loss Order

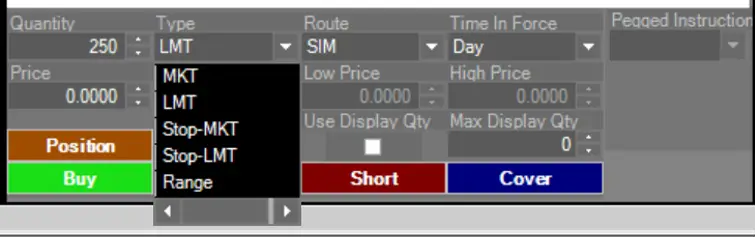

Stop loss order is one of the derivatives of the Stop Order. There are two types of stop loss orders: Sell Stop Lost Order (For LONG) and Buy Stop Lost Order ( For SHORT). To send one of the orders, you are required to input the trigger price. A market order would then be sent when the security’s price reaches the trigger price.

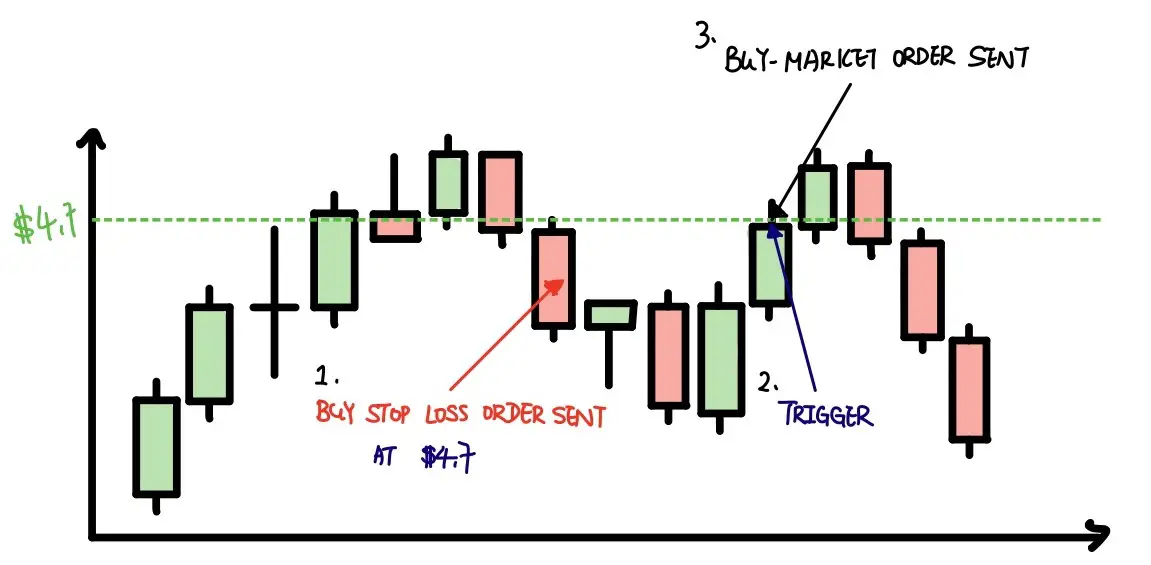

Sell Stop Loss Order (Example)

For instance, you have sent a sell stop loss order with a trigger price at $5. Your securities would be sold immediately with a market order (by default) if the security price reaches $5 (Trigger Price).

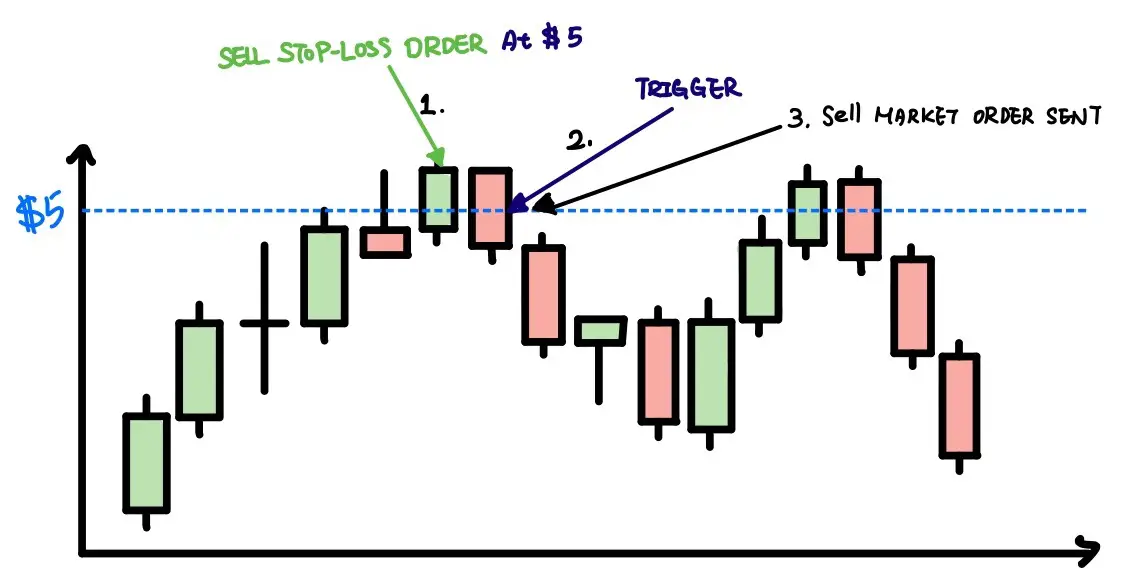

Buy Stop Loss Order (Example)

For instance, you have sent a buy stop loss order with a trigger price at $4.7. Your position would be covered immediately with a market order (by default) if the security price reaches $4.7 (Trigger Price).

Stop Limit Order

The Stop-Limit Order is conceptually the same as the Stop-Loss Order except for the order it sends after the security’s price reaches the trigger price is a Limit Order. To send a Sell Stop Limit Order (For LONG) or a Buy Stop Limit order (For SHORT), you are required to enter two prices: Trigger price and limit price that you are willing to cover or sell the position.

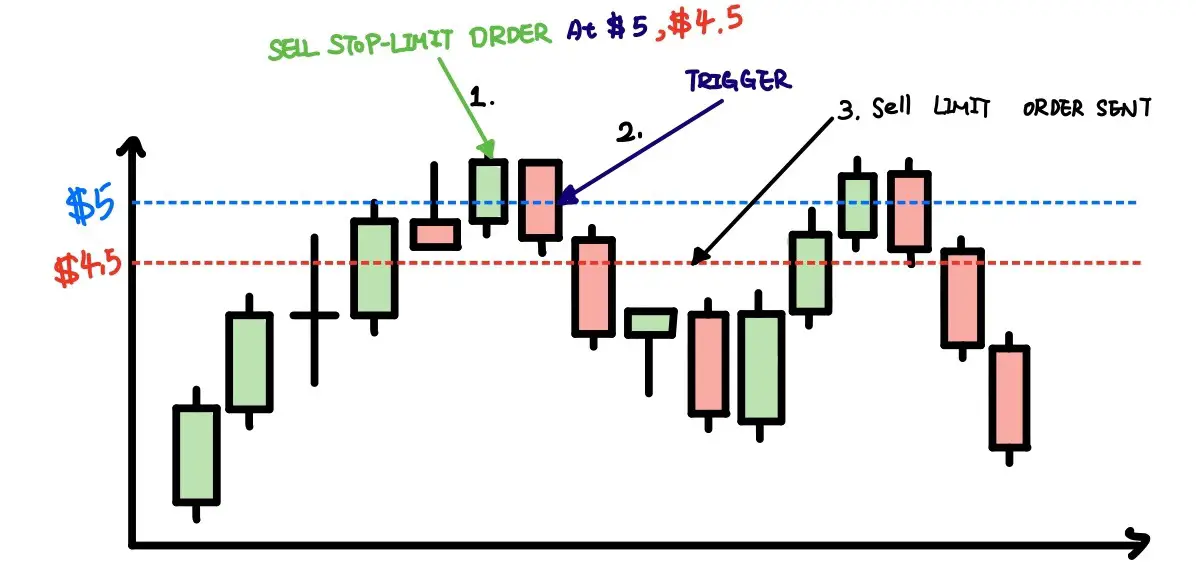

Sell Stop Limit Order (Example)

Let’s say you sent a Sell Stop Limit Order with a Trigger Price at $5 and a Limit Price at $4.5. A limit order would be sent with the price $4.5 (your limit price) to sell your securities when the security price reaches $5 (Trigger Price).

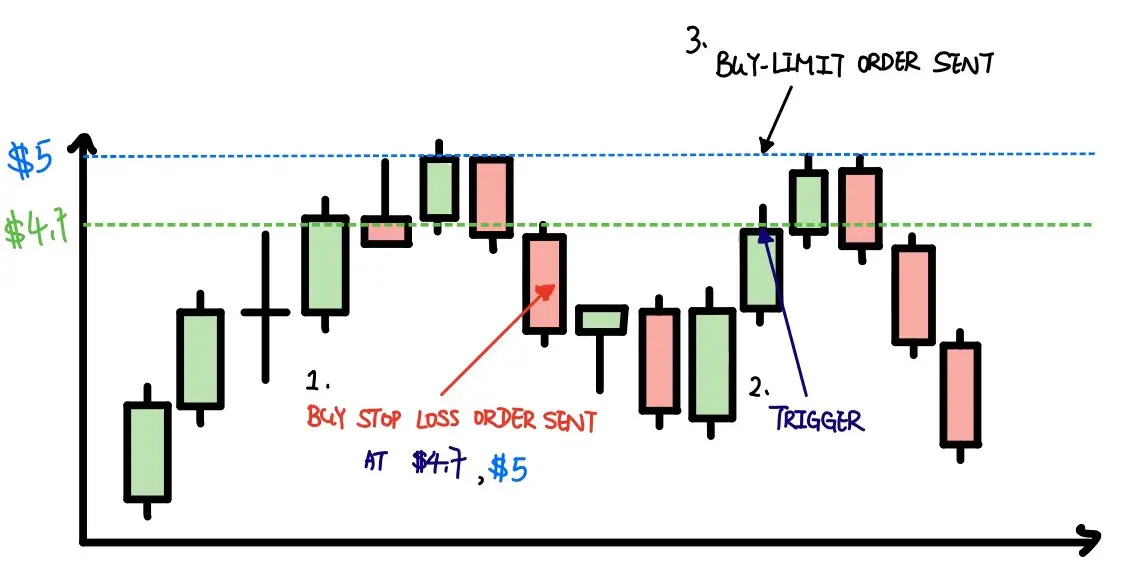

Buy Stop Limit Order (Example)

Let’s say you sent a Buy Stop Limit Order with a Trigger Price at $4.7 and a Limit Price at $5. A limit order would be sent with the price $5 (your limit price) to cover your position when the security price reaches $4.7 (Trigger Price).

Thing should be beware when using the Stop Limit Order

If the security’s price goes below or above the price that you are willing to sell or cover your position (the limit price), your order would not be filled no matter if the Stop-Limit Order was triggered or not.

(Tips: Remember to keep some space between the Stop-limit price and the trigger price )

Pros and Cons of using the Stop Order

Pros

1. Better Risk management

2. Help to sell your security when the trend is going against you, and you are not willing to sell them. (Stop Loss)

3. Could help you to lock up profit.

Cons

1. Profit may be locked in too early when the security got potential.

2. Stop order may be triggered with some big instant drop or spike.

Final Thought

Acquiring how to use the Stop Order would help you to become a better trader. My personal experience tells that people hate to accept their failure and loss. They will thereby not sell or cover their position when the market goes against them. And that’s the time people suffer a huge loss. The reason behind this phenomenon involves the Psychology of Behavior, and it’s complicated. But in general, it’s because losses would not be made when people are still holding their position. To encounter this problem, stop orders are suggested to be used.

[Next Lesson: Trailing stop order]